Once upon a time, in the bustling heart of Accra, there stood a beacon of hope and progress known as the Heritage Bank. Founded on dreams of prosperity and a commitment to integrity, this financial institution was more than just a bank; it was a symbol of Ghana’s potential and a testament to the entrepreneurial spirit of its people.

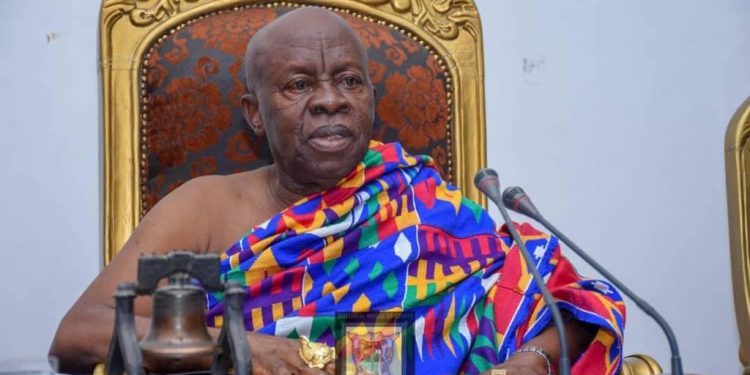

Heritage Bank’s story began with a man who dared to dream big. He was an ordinary Ghanaian, driven by an extraordinary vision to create a bank that would serve the underbanked and contribute meaningfully to the nation’s development. This is Alhaji Seidu Agongo, a well-known Ghanaian philanthropist. His journey to success was not without challenges – at point in his life, he mended shoes as a cobbler -, but with grit and determination, his entrepreneurial ventures transformed Nima, a community in the national capital, Accra, into a hotbed of trading activities: primarily dealing in rice and sugar.

“Everyone knows me at Nima as ‘Seidu, The Rice Seller’”, Alhaji Agongo recalled in an interview with a local TV station CTV that, “Banks were unable to count my money and, so, they did what they could and returned the following day to continue counting the money”.

So even long before he ever landed any government contract as a businessman, Seidu Agongo was raking in millions of dollars on a daily basis from his Nima enterprise.

Since the rice, sugar and the rest were imported and thereby creating jobs in other countries, Alhaji Agongo was compelled to challenge that status quo and started searching for institutionalised businesses protected by government regulations to establish more businesses.

“That’s what got me to set up Heritage Bank. Such businesses can outlive me and last for decades because they would have had protection from government regulatory institutions,” the entrepreneur stated.

Heritage Bank was incorporated in 2014 and earned its license in 2016.

Within a few years, Heritage Bank thrived. It provided loans to small businesses, supported community projects, and offered financial services to people who had long been overlooked by larger institutions. Its books were impeccable, audited by some of the best in the industry, and consistently met the stringent requirements set by the Bank of Ghana. Analysts praised the bank for its solid financial health and innovative approach.

But beneath the surface of this success story lay a brewing storm. In the corridors of power, forces were conspiring against Heritage Bank. The owner’s past dealings with Ghana’s primary cocoa industry regulator, COCOBOD, albeit genuine and clean, became the focal point of a legal dispute. Despite the legitimacy of his contract and the transparent use of the funds, the situation provided a pretext for those in power to act.

In a shocking turn of events, the Bank of Ghana, allegedly in collusion with the finance minister in the Akufo-Addo-led administration, moved to shut down Heritage Bank. They cited concerns over the legality of the owner’s initial capital—concerns that many saw as a smokescreen for more sinister motives. Despite the bank’s clean financial records and its crucial role in the community, the decree was swift and unforgiving: Heritage Bank was to be no more.

The closure was a devastating blow, not just to the bank’s employees and customers, but to the entire community. Small business owners who had relied on Heritage Bank for their loans found themselves in dire straits. Families who had saved diligently saw their future thrown into uncertainty. The dreams of students hoping to secure educational loans were dashed.

Employees of Heritage Bank, who had poured their hearts into their work, suddenly found themselves jobless. Many of them had grown with the bank, believing in its mission and values. Their heartbreak was palpable as they packed up their desks, leaving behind not just a place of work, but a community of like-minded individuals who had become like family.

For the founder, Alhaji Seidu Agongo, the collapse of Heritage Bank in January 2019 was more than just the loss of a business. It was the shattering of a lifelong dream, the erasure of years of hard work, and the cruel undermining of his integrity. His vision had been to uplift others, to create a legacy of financial empowerment. Instead, he faced public humiliation and the daunting task of clearing his name in a convoluted legal battle, which he triumphed at the end.

The public outcry was immediate and intense. Ghanaians from all walks of life took to social media, town halls, and other mediums to express their dismay and anger. They questioned the motives behind the closure, pointing to the impeccable records and clean audits of Heritage Bank. Many saw this as a blatant misuse of power, a move designed to crush a successful local business to serve hidden agendas.

In the end, the story of Heritage Bank is a poignant reminder of the fragility of dreams in the face of power and corruption. It is a call to action for all Ghanaians to stand up for transparency, justice, and the protection of honest entrepreneurship. The legacy of Heritage Bank, though cut short, lives on in the hearts of those who believed in its mission and in the ongoing fight for a fair and equitable financial system in Ghana.

It is worth noting that throughout his business journey, Alhaji Agongo has faced major challenges, some of which should have grounded him completely, but he always surmounted them and emerged even stronger and wiser for them.

And none of those challenges has ever dampened his business spirit or changed him from continuing to be the good and generous giver he is.

As the legal battle is over and Alhaji Seidu Agongo being discharged and acquitted by an Accra High Court, and the founder strives to reclaim his dream, the people of Ghana remain hopeful. They hope that one day, justice will prevail, and the true story of Heritage Bank will be told—a story not of collapse, but of resilience and the enduring power of a dream.

#BringBackHeritageBank

Source: Coalition for Restoration of Collapsed Indigenous Banks

The post #BringBackHeritageBank: Heritage’s License Revocation was a Bitter Injustice appeared first on Newstitbits.